The following is a translation of preliminary results from research conducted by José Ossandón, with the support of Tomás Ariztía, Macarena Barros, and Camila Peralta, and funded by IMTFI.

Luisa is a 54-year-old housewife who lives in the municipality of La Pintana, south of Santiago. Seven others live in her household: her husband Patrick, her children Nacho, Paty, and Andrea, her son-in-law Rafael, and her grandchildren Camila and Cristian. Luisa also has a fourth daughter Katia, who lives with her husband Rodrigo in the same neighborhood. Luisa’s husband Patrick works as a freelance painter sporadically, and he earns on average 150,000 pesos (US$312) a month. In addition to housework, Luisa manages a kiosco or small shop in her home, which earns her between 20-30,000 pesos a month. Andrea and her husband work and take care of their own expenses. Paty, in turn, is unemployed and so receives help from her parents to cover her expenses and those of her daughter. Nacho is studying nursing with the support of a loan (called a Crédito Aval del Estado, or State-Guaranteed Credit) and recently has begun to receive his first income as an occasional worker in construction. Luisa and her family maintain their home with the money that Luisa and her husband earn and with the financial support they receive from their children.

With regards to her financial life, Luisa has a savings account, an emergency fund of 40,000 pesos cobbled together with money from the kiosk in the BancoEstado, a state-owned financial institution. Since Luisa and her husband have informal jobs, neither has access to checking accounts or bank loans. Luisa is, however, an active participant in three informal financial institutions, two pollas (rotating savings organizations) and a caja común (“common fund”) that functions as a Christmas savings club. The caja can also be used as a source of credit, but under certain restrictions. Loans must be repaid with interest, there are fines for late payments, and if a member misses her quota for three consecutive dates, she is removed from the group and the money she has contributed up to that point is not returned to her.

Luisa also has access to loans offered by retail companies. Ten years ago, she acquired her first credit card in the department store La Polar and a few years later, ended up with cards from Paris, Corona, Tricot, Fashion Park, and Salcobrand. Two years ago, however, after feeling that her debts were spiraling out of control, she closed the Tricot, Fashion Park, and Salcobrand cards, and, a year ago, a loan renegotiation ended with La Polar blocking her card; today, then, she only holds cards from Paris and Corona. Luisa uses these store cards in various ways. For example, between September 2011 and February 2012, she used the AlmacenesParis card to purchase two pairs of sneakers for her son Nacho, a cell phone for herself, and merchandise in a supermarket, which is part of the same business group as the store and where this card is also accepted. Each purchase was paid for in six installments. She also used the Corona card for a cash advance.

But Luisa did not use her cards only for her own purchases. For example, between December 2011 and January 2012, Luisa lent her Paris card nine times to her daughter Andrea—three times for installment purchases of merchandise, another five times to purchase goods in the shop (shoes, an iron, an oven, and pants for her son), and once for a cash advance consisting of six installments of 15000 pesos each. In addition, in February 2010, Luisa lent her card from La Polar to Andrea to buy a refrigerator; she also lent her Corona card to Andrea for an advance of ten installments of 10,000 pesos. Luisa has also lent her La Polar card to her daughter Katya for a cash advance and for a furniture purchase, and the Corona card to her daughter Paty to buy an iron in ten installments. On two other occasions, moreover, Luisa’s son-in-law Rafael used her Corona card, once to buy himself sneakers and another time to buy a cell phone for his son.

In our qualitative study of the financial practices of thirteen households in three municipalities in low-income sectors of Santiago, we encountered many stories like this one. These stories, much like those recently described by Ariel Wilkis, do not necessarily fit into the traditional categories associated with studies of popular finance. Here there is no clear demarcation between formal and informal financial inclusion. There is exclusion, without a doubt, in the sense that these stories are about people without access to bank credit, often because they do not have access to formal employment, or to so-called créditos sociales (“social credits”) from cajas and cooperatives. These stories also speak to popular finance, since like Luisa, many of our respondents are active participants in “pollas” or other rotating savings and credit associations. Yet, such stories also evince formal inclusion and economic rationality in the traditional sense. The credit cards of retail businesses are almost universally present in the homes we studied, and we encountered many stories of people who, over the years, have become experts on interest rates, loan renegotiations, and installments—a complexity that is multiplied if we also consider that many deal with several cards at once.

It is in this context that we encountered the practice of lending and borrowing retail credit cards. Obviously, we were aware before our investigation that, just as it is common for Chileans to lend health insurance vouchers (bonos) to one another, they also lend retail credit cards to one another. What we did not expect was that in every home we visited, we would find such lending and borrowing and the degree of complexity that emerged as a result. In this way, little by little, card lending came to constitute the main object of our attention. In this post, we use some elements of recent work in economic sociology to begin to unravel what this is all about.

Sociology of the Quota

In short, it is not difficult to associate the practice of card lending to the basic principle of the new economic sociology, as formulated by Mark Granovetter in 1985 (.pdf). At first glance, credit cards might appear to be private property, owned and managed by the person whose name is in the card, but closer observation of card lending reveals a parallel and collective circuit of debt—that is, a network. Still, how and what might we see were we to examine the lending of credit cards as a network? What are the nodes and types of relations? How to classify the types of actors involved?

Inspired by the description offered by one of our favorite sociologists John Law (2007) of the advantages of “pin boards” or bulletin boards as a way to think visually, we felt we should pursue a more experimental path to understanding such lending networks. Instead of working directly with relational data visualization software (such as Pajek), we, therefore, decided to embrace the flexibility afforded by using our own hands. Armed with the necessary materials—cork bulletin board, yarn, and pushpins of different sizes and colors—we met to search for a way to think visually about what we were finding.

This is the case of Luisa. The red pins represent her and her husband, and blue pins below, her daughters and sons. The large pins represent retail store cards. In this case, Luisa is the only one with cards—one from Paris, one from Corona, and another from La Polar. The yarn threads represent uses of a card involving some form of credit, and they connect the person who receives the loan of the card with the credit card used for the transaction. As can be seen, Luisa has used her three cards for personal transactions, but the same cards have also been used by her daughters and sons-in-law.

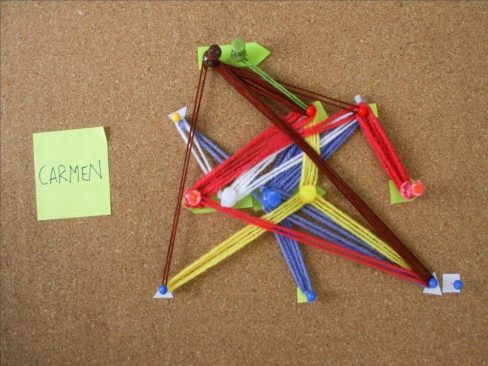

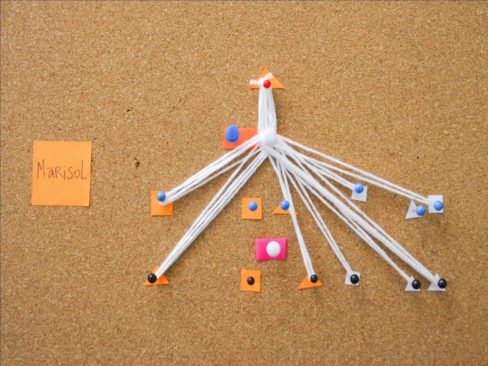

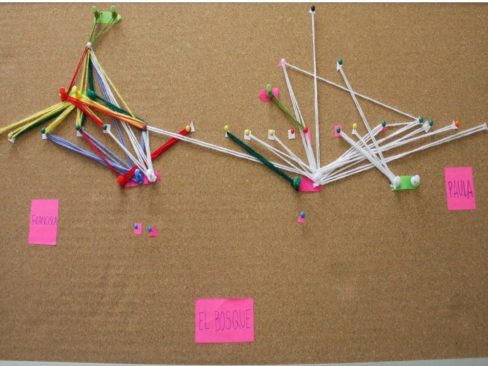

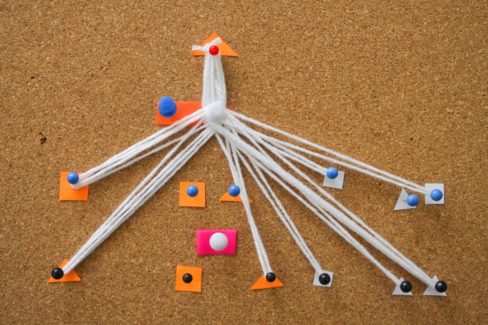

We completed similar exercises with the other twelve households. Seen below are the networks of retails card use in the households of Carmen, Marisol, and Yeni.

After several attempts, the images you can see here have left us satisfied as a good way of visualizing our data. But the central question remains: So what? What is this all about? As has been already mentioned and as can be seen clearly above, credit card lending practices produce networks. But what kind of collective or social formation are we talking about? At what level do these networks operate?

The Scale of the Quota Economy

One option is to focus on the nuclear family or household as the fundamental unit of such networks. As we saw in the same case of Luisa, however, card lending can span different family units living together in the same residence. A second option is the family or networks of extended kinship. Luisa not only lends her cards to her family members living in the same property, but also her daughter Paty, who lives in another house. In several of the cases studied, however, we found card lending extending beyond the family to friends and neighbors. The case of two homes that were connected via two friends turns out to be instructive in this way.

A useful concept for expressing this particular type of social formation is that of “commercial circuits” developed by sociologist Viviana Zelizer (2010), which refers to circuits of economic transfers among a delimited group of actors, who bestow upon these transactions a shared meaning. These circuits of transactions establish a clear line of belonging and make use of a particular medium of payment. We suggest that each of these networks of credit card lending functions as a commercial circuit that frames or connects to existing collectives—neighborhoods, families, or households—but that also has its own emergent character and forms of inclusion and exclusion. Indeed, as shown in the first of the following citations, an important part of the interviews revolved around the edges or boundaries drawn when a commitment is broken and how the limits of these circuits can be re-established.

“Flor, my neighbor, was slow to pay, so now I don’t lend them [cards] to her, because then she takes a long time to pay and I have to pay everything myself. And afterwards, they screw you with the card.” (Luisa)

“Imagine, for instance, each installment is 10,200 pesos. I give my mom eleven or twelve lucas [Chilean slang for 1,000 pesos], I always give her a bit more, because they always charge my mom for the mail service, the use of the cards, whatever damn fee they add—a thousand of this, fifteen hundred of the other. It’s the same with my dad, they are always charging him five lucas extra, so I always give some money on top [of the installment amount] to my mom.” (Patricia)

Moreover, as the second quotation, taken from another case, illustrates, such circuits entail a system of parallel calculations, which are in fact often drawn in the margins of the monthly bill.

But what is lent? What is the medium of this circuit? To understand this, it is important to consider that here we are not talking about just any network. In more technical terminology, these are 2-Mode networks, since the actors are not connected directly among each other, but through nodes of a different type. What we have here are people connected among each other through the use of a common card. The cards, in turn, are not just any node. They correspond to what Callon, Millo and Muniesa (2007) have called “market devices”—that is, objects that do not only mediate between humans, but have an active role in the transformation of the relations that they connect.

Unlike a traditional commercial exchange, whose mode of payment is cash and for which there is no record besides the receipt, every transaction realized with a card is recorded, as the bills we receive at the end of each month repeatedly remind us. This information is key to the operation of retail companies, which statistically evaluate the behavior of each of its customers. The type of evaluation performed by Chilean retailers is called “sowing” (Ossandón 2012), and it consists of extending credit, or increasing the credit limit associated with each card, not only based on external variables (such as income, age, or state of employment), but also on payment behavior. In other words, if the card lending among family members and friends is “managed” well, in the sense of paying off the debts as they are generated, the increased use of the card increases the credit limit assigned to it.

This brief “socio-technical” detour is important, because it allows us to understand something key, that the medium of the commercial circuit described here is the credit limit itself. People do not lend money, but the capacity to borrow and go into debt, their quota (or “cupo” in Spanish, a word that suggests both a bound and an allotment), that is delimited by the algorithms of retailers’ risk analysis systems. It is, therefore, no coincidence that at the center of our networks we find “dueñas de casas” (female heads of household). Their centrality is directly related to the “discovery” by stores’ analysts that adult women are statistically better “pagadores” (payers), despite sometimes lacking their own income. What stores probably do not know—or do not care to know, since their concern is timely payment, not a sociological understanding of what lies behind each customer—is that behind each card is the emergence of a new financial circuit, an entire “economy of the quota.”

In this post, we have used some visual and conceptual tools of economic sociology to begin to understand this economy. But this is only a first step. We believe that deepening our understanding of this economy of the quota (economía del cupo) is not only academically relevant, but also may help us to understand better how the boundaries between financial inclusion and exclusion are being reformulated today …

* The names in the cases and quotations have been changed to maintain anonymity.

Text prepared by José Ossandón for 7th Chilean Congress of Sociology, University of La Frontera, Pucón—24, 25 and 26 October 2012. From the work of the research team led by Ossandón, with the participation of Macarena Barros, Camila Peralta, and Tomás Ariztía. Study developed in Programa de Estudios del Consumo y los Mercados, Instituto de Investigación en Ciencias Sociales (ICSO), Universidad Diego Portales, and funded by the Institute for Money, Technology and Financial Inclusion at the University of California, Irvine.

Text in Spanish originally posted at the blog Estudios de la Economia. First posted in English on the Institute for Money, Technology and Financial Inclusion blog and reproduced here with permission. Translated by Taylor Nelms, with assistance from Smoki Musaraj.